We are now accepting Form 2290 for the 2022-2023 Tax Year.

File 2290 Now

What is IRS Form 2290?

The IRS 2290 Form is used to calculate and pay heavy vehicle use taxes for commercial motor vehicles that use public highways. If your vehicle weighs 55,000 pounds or more and is operated on public highways, you are required to file Form 2290 by the due date.

Please note that the IRS 2290 tax must be completed annually. And, If you have 25 or more vehicles to report you are required to complete your form online.

Create a Free Account to get started with your 2290 filing!

Visit https://www.expresstrucktax.com/efile/irs2290/ to learn more about IRS Form 2290.

File your IRS 2290 on or before Due Date

Officially the Tax period for IRS 2290 Form begins from July 1 to June 30 of the following year. And the IRS 2290 filing deadline is based on when you first used your vehicle on the road for the tax period.

For example, your IRS 2290 form is due on the last day of the month after the month that you first use your heavy vehicle on a public highway. If your first use month is January, then your IRS 2290 form is due by the last day of February.

Most truckers first use their heavy vehicles in July at the beginning of the tax period, and August 31 is considered a major deadline.

Visit https://www.expresstrucktax.com/hvut/irs-form-2290-due-date/ to learn more about IRS Form 2290 deadline.

About our IRS 2290 Filing Service

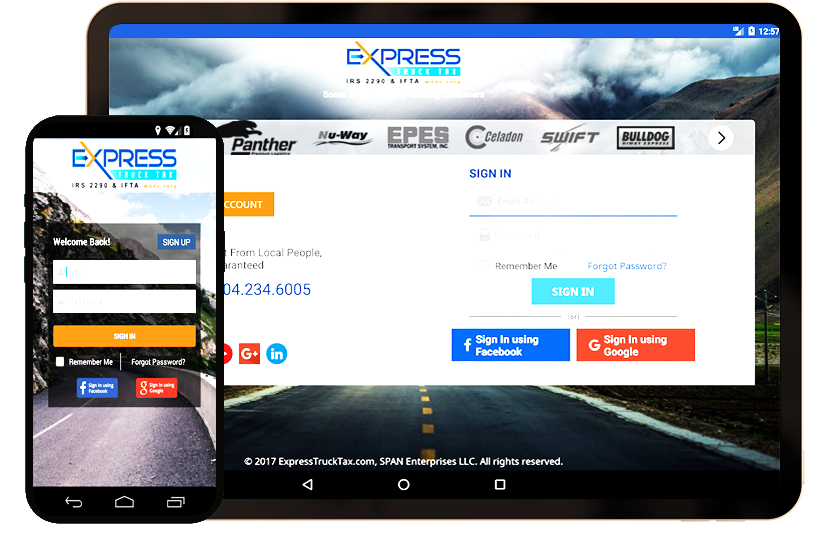

We are the market leading IRS 2290 e-file providers, based in the small town of Rock Hill, SC. Our goal is to make your truck tax experience quick and easy by giving you the best instructions possible online. We pride ourselves in having the simplest 2290 filing platform with which you can complete your form in a matter of minutes and get your Schedule 1 instantly.

E-Filing IRS 2290 form using our service ensures that you will receive your Stamped Schedule 1 within a few minutes. You can also opt to receive schedule 1 using fax or postal mail.

And if you have more vehicles or businesses to report, you can use our bulk upload feature to import all of your data at once and complete your filing. Plus, you can copy your previous IRS 2290 tax form information to your current return to save time while completing IRS Form 2290.

Our dedicated support team is always standing by to answer all of your IRS 2290 tax questions. As truckers keep our economy moving we pledge to always work towards making the IRS 2290 e-file process even easier for you.

IRS 2290 Filing Features

Receive Stamped Schedule 1 in Minutes

Receive your Stamped Schedule 1 in about 15 minutes after completing your IRS Form 2290 with our Software.

Guaranteed Schedule 1 or Your money Back

We guarantee that you will receive your Stamped Schedule 1 from the IRS or your Money Back.

Free VIN Correction

If you have Previously Filed IRS 2290 with us and noticed any VIN error on your 2290, you can Correct it for Free and get the updated schedule 1.

Retransmit Rejected Returns for Free

In case if your 2290 is rejected for any error, you can easily fix the errors and re-transmit it again with the IRS for free.

Supports Amendment

We support 2290 amendments where you can file 2290 for vehicles exceeding mileage or for vehicles that have fallen into the new taxable gross weight category.

Claim Tax Credits

In case you need to claim tax credits on your IRS 2290, you can file Form 8849 (Schedule 6) and claim tax credits from the IRS.